BUY-SELL TRUST

I need to find an exit for my shares when I am not around.

A well-constructed plan is essential to protect the value of the business and provide cash for the family in the event there is a major disruption in the business due to a co-owner’s death, disability, retirement or serious major illness or any other event that jeopardizes the continuity of the business.

Ask yourself:-

- If a co-owner dies today, can you work with his family to run the business?

- Will the co-owner’s family members know how to run the business with you?

- Can they work well with you?

- Would your beneficiaries be able to get a fair price?

- Do you have the funds to buy out the co-owner’s shares/interests from the family members when there is no pre-agreed price in a written agreement?

- Can the shares/interests you are purchasing be transferred quickly to you?

Problems Without Business Protection Plan

Often these are:-

- A new partnership is created due to the inheritance of the shares/interest by inexperienced heirs. Chances are this new partnership may fail.

- There is no pre-agreed price for any sale to take place when the heirs decide to sell to the other co-owners. As a result, it may take years to settle a transaction price.

- Some of the unqualified heirs may insist on being directors of the company and be active in running the business. This may lead to serious disruptions and disputes within management.

- It is possible that the co-owners may decide to abandon the business and start their own due to disputes with the heirs.

- Loss of profits and uncertainty about the business future success.

After all your hard work in building your business, you need to avoid such problems.

THE SOLUTION – BUY-SELL TRUST

Our Buy-Sell Trust ensures a smooth transition of the business to the other co-owner(s) and the value of your share of the business is protected against an event such as:-

- Death

- Bankruptcy

- Incapacity

- Divorce

- Ill health

- Loss of professional license

- Retirement

- Deadlock between co-owners

Our Buy-Sell Trust consists of:-

- Buy-Sell or Cross Option Agreement: covering the terms of the sale and purchase including the agreed value or formula, events triggering a sale, funding and mode of payment.

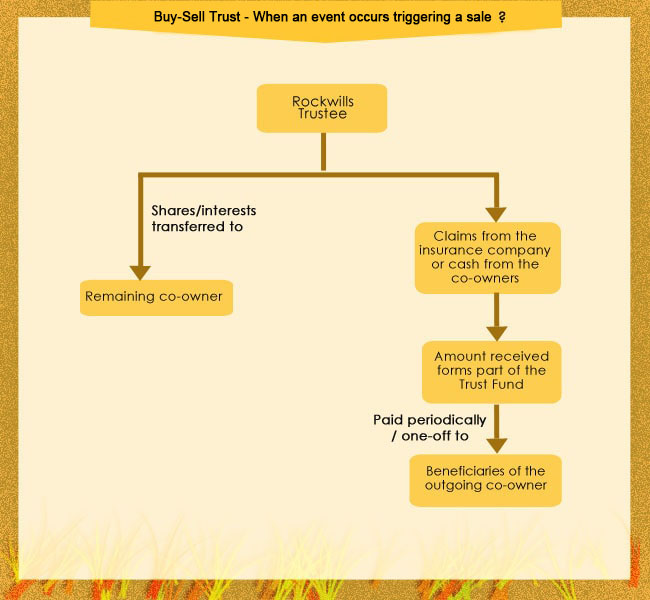

- Power of Attorney: authorizing us, Rockwills Trustee, to transfer the shares/interests to the other co-owner(s) upon the occurrence of the agreed events that trigger a sale.

- Trust Deed by the co-owners: instructions to Rockwills Trustee regarding the periodical distribution of the sale proceeds to prevent these being misspent by the beneficiaries.

- Life insurance policy: as the main funding mechanism to purchase the shares/interest of the outgoing co-owner.

BENEFITS OF BUY-SELL TRUST

|

Fair Value You determine the selling price for your shares that is agreed upon with your partners, so your beneficiaries will receive a fair value in proceeds. |

|

Smooth Transition Your business can carry on without issue as your Buy-Sell Trust prevents inexperienced individuals from getting involved. You are assured that we will carry out our Trustee duties according to your expressed wishes. |

|

Life Insurance Taking out a life insurance policy will ensure that the buyer(s) of your shares will have the necessary funds to pay for them when the time comes. |

|

Impartiality It is good to know that we are completely impartial and professional in carrying out our duties, safeguarding the interests of your beneficiaries and partners at all times. |

|

Liquidity Cash flow is important to maintain the lifestyle of your beneficiaries. Buy-Sell Trust ensures that your business shares are easily converted into cash, with timely payments to your loved ones according to your written instruction. |

"请立即行动,订立遗嘱留下关怀与爱心的遗产。"

" Call Rockwills Service Centre today, Protect your family and leave a legacy of love and care. "